Bethlehem / PNN /

Businesses in the West Bank city of Bethlehem are facing mounting financial pressure amid a deepening liquidity crisis, as local banks increasingly refuse to accept deposits in Israeli shekels. The shortage of shekel liquidity has led to partial paralysis in commercial activity and undermined many businesses’ ability to meet financial obligations, including payments to suppliers and staff.

In response, the Bethlehem Chamber of Commerce and Industry conducted a survey involving 61 member businesses to assess the scale of the disruption and offer data-driven insight to policymakers. The initiative also aimed to identify practical mechanisms for mitigating the crisis’s impact on the local economy.

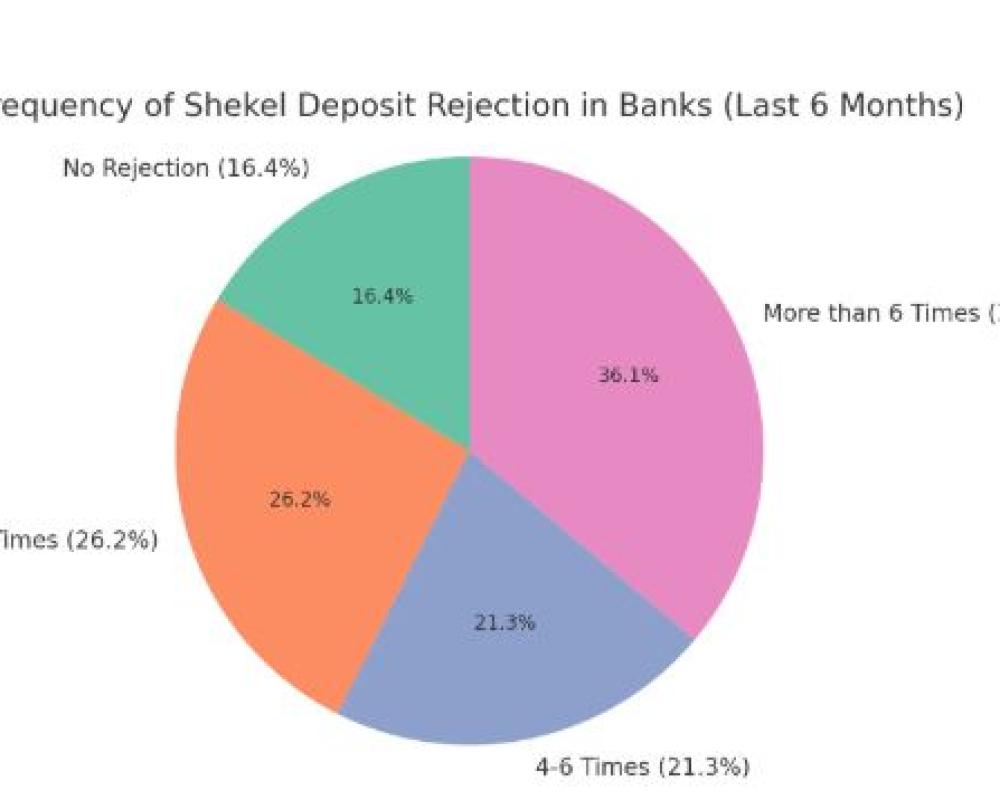

Survey findings show that more than one-third of respondents had their shekel deposits rejected by banks more than six times in the past six months. Roughly 26% experienced between one to three rejections, while 21% reported four to six instances of rejection. Only 16% said they had not faced any deposit refusals.

A significant majority—82%—reported that deposit refusals had disrupted their business operations, while 18% said their activities continued without notable interruption.

Among the most severe consequences was the inability to honor checks. Over 80% of respondents said they struggled to process check payments due to banking restrictions. Nearly 69% were unable to purchase raw materials or essential goods, and 44% could not pay employee salaries on time.

In search of solutions, more than two-thirds of business owners said they had turned to alternatives. Some 56% adopted electronic payment systems, while 42% exchanged shekels for U.S. dollars, and around 30% converted currency to Jordanian dinars. Still, a significant portion of businesses have yet to adopt these alternatives effectively.

Despite the push toward electronic payments, 44% of respondents said they had not used them at all. About 21% reported using digital transactions for less than 10% of their operations, with higher usage rates limited to a minority of participants.

Business owners stressed the urgent need for decisive action, warning that the crisis not only harms traders but also poses broader threats to the local economy. They called for a unified response from banks, the Palestine Monetary Authority, chambers of commerce, and the private sector.

Participants urged banks to accept cash deposits without conditions, particularly those intended to cover checks and outstanding dues. They also criticized what they described as exploitative currency conversion rates, calling on banks to absorb part of the financial burden instead of passing it on to clients.

The Monetary Authority was urged to streamline procedures for business clients, lower transaction fees, expand digital wallet limits, and facilitate the issuance of electronic payment cards and checkbooks.

The role of local chambers of commerce—especially the Bethlehem Chamber—was emphasized as essential in representing business interests and coordinating with financial institutions. Suggestions also included easing foreign currency transfers for tourism-sector workers and reducing tax and licensing burdens as part of an emergency economic response.

Other proposals included establishing an independent Palestinian body to manage shekel transactions without Israeli oversight, founding non-profit banks run by Palestinian entrepreneurs to provide low-cost financial services, and gradually phasing out the shekel in favor of the dinar or dollar as a long-term strategy. Respondents also called for raising the monthly deposit ceiling to 100,000 shekels, particularly for businesses with high-volume operations.

The survey highlights the growing strain on Bethlehem’s economy and underlines the urgent need for intervention by financial and governmental institutions to prevent the shekel crisis from deepening further—potentially spilling over into other West Bank governorates if left unaddressed.